China faces real estate crisis

China has seen a severe downturn in its real estate market this past year.

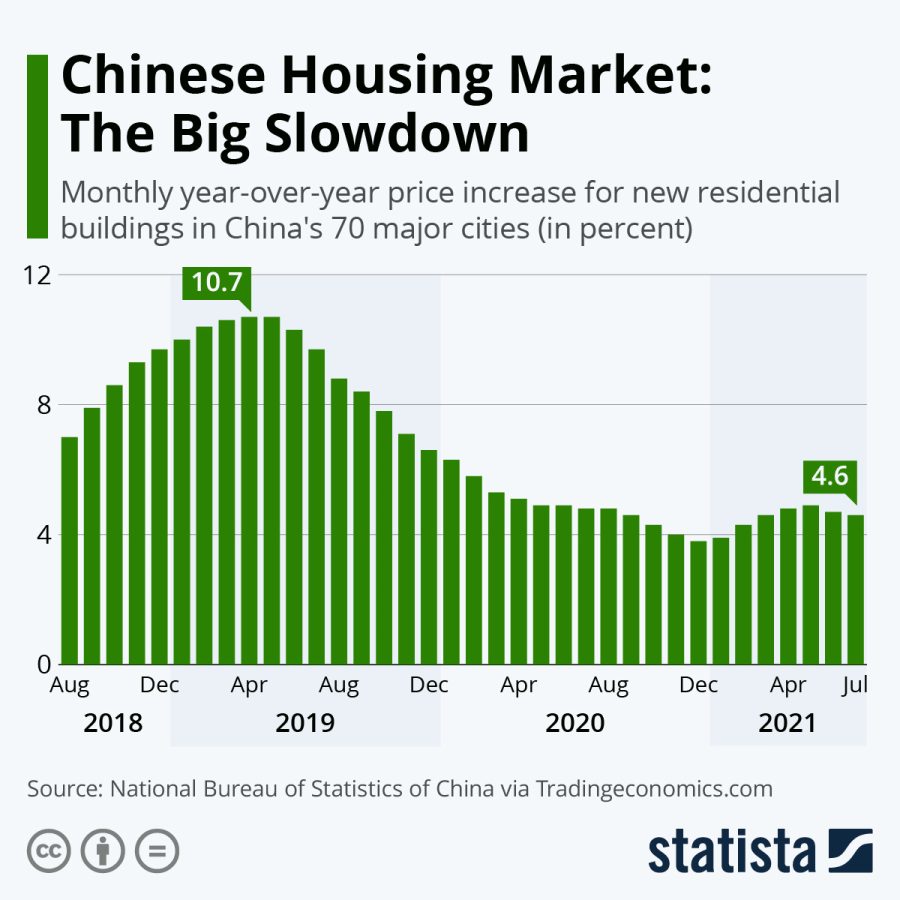

In 2021, China’s real estate market was worth a whopping 18 trillion yuan ($2.65 trillion), according to Al Jazeera. The same property market that ranks China as the second-largest economy in the world, has seen a staggering decline in growth since October. Independent research provider Rhodium Group consultant Logan Wright calls this situation a “slow-motion financial crisis” characterized by low property prices and faulty developer defaults. This slumping market, along with national debt, signals the end of growth and expansion of China’s economic success.

Hundreds of thousands of homebuyers are refusing to pay mortgages due to construction delays and pre-sold properties have been left unfinished. This has caused a crisis that the government cannot fix, at least not easily. This is concerning given that 15-30 percent of China’s Gross Domestic Product (GDP), relies on the property market and investments.

The acute stress of the market is said to be “policy induced.” In 2020, Beijing developed a “three red lines policy” to lessen the economy’s reliance on property values and figure out why housing prices had become out of reach for many middle-class Chinese. The Beijing policy required developers to put a 100 percent net debt cap on equity and forced many of them to borrow from banks and fall into massive debt. According to Al Jazeera, property prices now are down by more than 30 percent since the implementation of the three red lines.

As of November 14, 2022, Chinese authorities have been making a large effort to alleviate this crisis which has plagued the economy over the years. After Beijing released a 16-point plan that eased the previous crackdown on developers in the real estate sector, China’s biggest developer Country Garden grew by 52%, according to CNN. Banks are now extending loans to developers, supporting property sales, and reducing mortgage rates and the size of down payments on homes. This year is predicted to put more than 1 trillion yuan ($142 billion) into real estate as estimated by Chief China economist Tao Wang. Yet, the crisis still seems to heighten as angry homeowners continue to refuse to pay mortgage prices.

How does this crisis affect the United States? China’s lower property values and GDP could affect America’s ability to issue new debt, according to the U.S. Treasury. If China’s economy slows down, then U.S. exports will be far greater in respect to imports. The demand for U.S. exports such as aircrafts, automobiles, and food will also decrease. As China’s exports to the U.S. decline, this translates to less demand for U.S. debt. This all falls into a chain reaction because as China’s demand for the U.S treasury falls, then so does the demand for the dollar.

It is not yet known if China will pull themselves out of this real estate crisis in a timely manner as well as implement more policies that lessen the stress on developers and civilians of the nation.

Batul Elbarouki is a Senior and one of Eastside's Global Commentary Editors for the 2022-2023 school year. You can often find her with friends or doing...