Paying the cost of higher education: Can student debt be relieved?

March 29, 2023

The increasing cost of college tuition creates a growing disparity between what many students can afford and what they must cover through loans. On top of an already difficult college application process, students must now face the discouraging financial truth of America’s education system. While scholarships and Federal Pell Grants are offered and may cover a small portion of a student’s tuition, the rest is turned into debt. In 2022, President Joe Biden made steps towards fulfilling his campaign’s promise to ease student debt. His three-part plan – which could relieve tens of millions of Americans up to $20,000 in their student debt – is currently being decided upon in the Supreme Court.

High tuition costs affect students’ college decisions

According to Forbes 2023, the average federal student loan debt in the United States is roughly $37,574. The total student loan debt in the United States is $1.75 trillion as of early 2023. 55% of students from public institutions took on student loans. 57% of students from private institutions took on student loans.

College tuition in the United States has consistently risen over the past 30 years, having grown at a faster rate than federal debt. Furthermore, the United States ranks as one of the top countries with the highest private and public average annual tuition fees. So it comes as no surprise that students in America are drowning not only in financial debt but constant stress and worries as well.

To many students, the burden of the high tuition cost of universities across the nation factor into their college decisions and lifestyles.

“Tuition affects me because it is an important indicator when choosing a college. If a school does not give me enough scholarship, I would reconsider my decision,” said Youjin Park, a current freshman at the University of Pennsylvania.

Many students have experienced the same struggle. It has come to the point where financial aid and scholarships are their sole solution to the hardships of college expenses. As the idea of loan debt may load a great weight on students and create concerns for the future, many students are forced to give up their dream and preferred schools due to their financial situations that limit their freedom of choice of education. Financial aid through government programs like the Free Application for Federal Student Aid (FAFSA) or simply school scholarships lift a bit of this pressure and can change the student’s educational path.

For Yena Son, a current freshman at Northwestern University, scholarships have guided her not only in her decision to further advance her studies at the college but have also assisted her in transitioning into college easily.

“I received a small scholarship from Northwestern [University] to help me find my flights for break, textbooks, a new laptop, etc. to help me get settled in at the beginning of the year,” said Son.

In all, this assistance impacts students to create a more affordable, stress-free college experience. As it prevents students from sacrificing their goals or the struggle following their admission, financial aid holds a key role in education in the United States.

“It helps me to fully focus on my studies and I don’t have to worry about paying for student debt after graduation,” said Park.

President Joe Biden proposes a student loan forgiveness program

College tuition debt restricts graduates’ abilities to immediately bring in substantial income when entering their post-college career. After years of study to earn a degree, students are left in deep financial holes, working to pay back the money they borrowed for their education. College tuition debt damages students’ goals and education paths: many college students are not able to finish college due to the cost, causing them to drop out while still having to pay off their original debt from their first semesters.

Biden’s presidential campaign promoted the relief of college fund debts. The proposal seemed timely as the pandemic temporarily delayed students from their repayments. Biden and other debt forgiveness activists saw the discrepancies in the current college tuition system. According to a Department of Education analysis, the typical undergraduate student that received loans now graduates with nearly $25,000 in debt.

As the cost of tuition has substantially increased over the past four years, the maximum Pell Grant value has held relatively constant causing a large disparity between what students have to pay and what the Pell Grants cover. Pell Grants is money given to students by the federal government that does not need to be repaid. While Biden has continuously extended the pause on student loan payments during his presidency, more radical action was needed to address the growing student debt issue.

While Biden has advocated for free community college and doubling the maximum Pell Grant, he started his financial policies a little less rigorously: Biden proposed a three-part plan.

First, Biden recognized that Pell Grant recipients have a harder time repaying their debt. Those who received Pell Grants would be given up to $20,000 if their loans are from the Department of Education. Those who did not receive Pell Grants could receive up to $10,000. These debt relief benefits would only be available to those with an individual income of less than $125,000 or $250,000 for married couples.

Who qualifies for Pell Grants? According to whitehouse.gov, “Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree”. Almost all students that apply come from families with an income of $60,000 or less. Students apply through the Free Application for Free Student Aid (FAFSA). The maximum Federal Pell Grant award for July 2023 to June 2024 will be only $7,395. Multiple variables affect the grant’s value including the cost of the school and family contribution. With the United State’s average yearly tuition around $40,000, the maximum Pell Grant value only covers around 18.5% of this value. For these Pell Grant recipients, the other 81.5% of tuition will be covered largely by loans.

The second part of Biden’s proposal creates a more manageable student loan system by lowering monthly student debt repayments and granting certain borrowers forgiveness based on their profession or volunteer work. Currently, graduates pay 10% of their discretionary income towards repayment; however, under this plan, the Department of Education will lower this rate to only 5%, helping to relieve the financial burden on low-income recipients. Furthermore, a new rule will be proposed to provide extra forgiveness to those who have worked in the government, military, or at a nonprofit.

In the last part of the plan, the Department of Education will hold colleges accountable for keeping their prices reasonable.

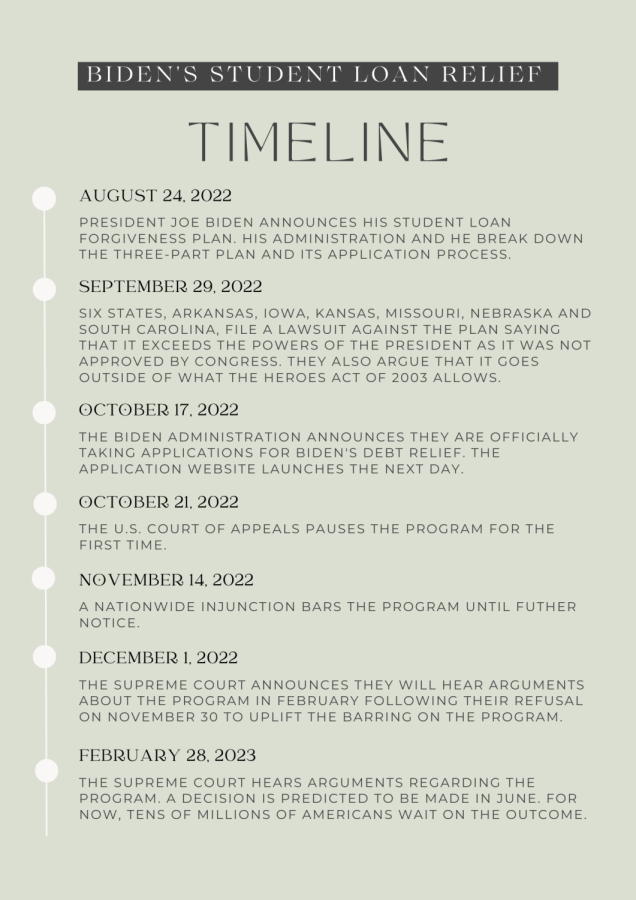

While many saw the proposal as a major benefit, it received backlash. On September 29, 2022, six states, Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina, filed a lawsuit against the program. The states believed that the program exceeded the powers of the President as it was not approved by Congress. While the Secretary of Education can make changes to the federal student loan system during national emergencies, a power granted by the Heroes Act of 2003, the authority to enact the program was questioned as it did not seem within the modifications allowed in the act. The states also made the point that the country entered a national emergency over 2 years before due to Covid-19, so Biden was just using this as a way to pass his program.

The Supreme Court heard arguments on Biden v. Nebraska and U.S. Department of Education v. Brown on February 28th, 2023 regarding the legality of the case. The decision is estimated to be made this June. So far, the program has been strongly questioned due to the many factors that play a role in the program. Large-scale federal forgiveness has not been done before so there are many questions regarding the constitutionality of the Secretary of Education to forgive debt.

A timeline of Biden’s student loan relief program

Equity vs. Equality: Examining arguments for and against the fairness of forgiveness

Should the federal government strive for equity, making sure that everyone gets what they need to succeed? Should the same government strive for equality, working to give all of its citizens equal opportunities and resources? Some might be tempted to answer both questions in the affirmative. After all, creating equity and equality sounds like a great way to help people across the nation.

What happens, though, when both equity and equality cannot coexist — when one must be chosen over the other? That question is at the core of one of the biggest debates in U.S. politics today: should we forgive student loan debt?

Advocates for forgiveness often invoke equity in their arguments, saying that loan relief will help the people who most need such assistance, creating equitable economic footing for more Americans. Meanwhile, people who are opposed to forgiving student debt tend to focus more on equality. They point out that many Americans have worked hard to pay off their student loans. Would it be fair for those Americans’ tax dollars to fund other Americans’ pursuit of debt relief that they have already independently achieved?

In order to better understand this debate, it is important to understand who exactly will receive student loan relief if President Joe Biden’s plan is allowed to go into action, pending current court challenges. Foremost, the plan would target low- and middle-income families, according to the Biden administration’s classifications. Specifically, people who earn an income of $125,000 individually or $250,000 as a couple or head of a household could qualify for student loan forgiveness. From there, forgiveness would be doled out based on Pell Grant status. Pell Grants are financial awards that the government has long used to aid low-income undergraduate students. So, if loan forgiveness applicants previously received a Pell Grant — and thus have likely endured greater financial hardship — they will receive $20,000 in loan relief under Biden’s plan. For people who did not receive a grant but do meet the income threshold, $10,000 in relief would be available. And, critically, all of this aid would be administered “up to” applicants’ remaining debt levels. So, if someone would qualify for $10,000 in relief but only has $8,000 left in loans, they would only receive $8,000 in government assistance.

It may be that last point that is most controversial. Many older Americans have already paid off most or all of the student loans they took out. For them, this whole initiative could feel like a burden. They worry about the national deficit, which would increase by $400,000,000,000 under Biden’s plan, according to the Congressional Budget Office, and whether it will ultimately be their tax dollars financing that debt.

“Essentially, the debt burden is shifted off of the shoulders of those who signed the loans and onto everyone who pays federal taxes. If you’re like me, that’s fundamentally unfair,” said columnist Matthew Noyes in writing for the Foundation for Economic Education, a conservative think tank.

In addition to concerns like those of Noyes, who paid off his loans already, worries could exist among current, younger students. While many current college students can access Biden’s relief plan, current college freshmen cannot. Additionally, the Biden administration has stressed — mentioning it five times on the studentaid.gov website — that this is a one-time forgiveness program. Where does that leave the students who have not yet attended college? Without fundamental changes being made to education financing in America, it seems likely that student loan forgiveness could become necessary for millions of young people once again in years to come.

However, not all people are focused on those, young and old, who will not receive help from Biden’s current plan. Advocates for debt relief prefer to focus on who the program can help.

“I paid off all my student loans. I still support student loan forgiveness,” read the title of one opinion essay on the subject, published by David Goldstein for Vox in 2019. In the essay, he called arguments against the fairness of student loan forgiveness, “the kind of argument designed to tug at our most selfish impulses while ignoring the economic and political transformations that have left a generation of college graduates struggling under an unprecedented mountain of student debt.”

On both sides of the debate over student loan forgiveness, passions run high. Such is often the case when large sums of money are at stake. As Americans consider whether or not they support Biden’s plan, they have a lot to consider across a broad spectrum of issues that affect people of all ages.

Is student loan forgiveness equitable? Is it unfair and unequal? Could it be all of the above? The answers to those questions are up for debate, and the consensus Americans reach will have major implications for generations to come.

Abby Yu (’23) shares her perspective on college tuition

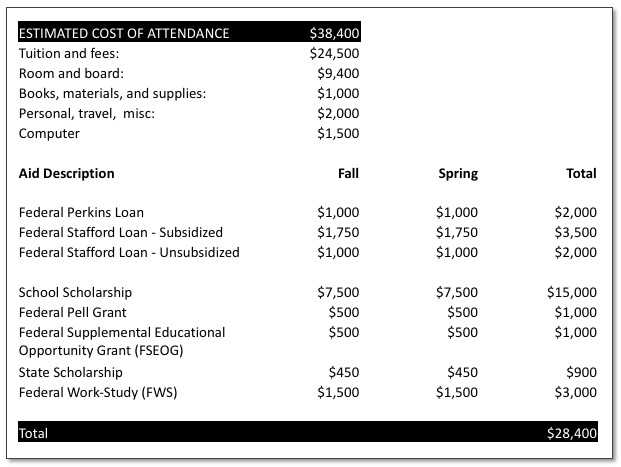

Student aid offer letters, like this example, often provide financial breakdowns of tuition when provided with aid.

In today’s world, there seems to be a conventional way of living: work hard in school, go to college and work for the rest of your life until you ultimately face the end. Pretty boring if you ask me. But if an individual decides to divert from that conventional path, they face discouragement and little support.

Although college is deemed necessary for success, the burden for paying for college often digs students into a deep financial hole. College tuition is a component of the application process that is dreaded by many, as some schools even charge up to nearly $80,000 per year. To put that in perspective, if you attend said college for 4 years, that is $320,000. That amount of money is also equivalent to a 6 bedroom house in Detroit, 32,000 burritos (assuming a burrito is ten dollars), 1,200 engagement rings and the list continues. Not only is the college application process itself stressful, but the thought and logistics of financial situations is another factor added to the mix.

As a senior in high school and the oldest child in my family, the whole process of applying for college was incredibly stressful and resulted in a tear or two shed. With Commitment Day steadily approaching, I’ve been able to narrow down my top schools down to The College of New Jersey (TCNJ) and Saint Joseph’s University. I plan on majoring in Early Childhood Education and utilizing both schools’ five year Masters and Bachelors program or their 4+1 program. I am lucky enough to say that I received a good amount of merit scholarships from both schools, but Saint Joseph’s offered me nearly $40,000 in merit scholarship a year while TCNJ offered me around $7,000. While this does alleviate the financial stress a little bit, there is one problem. My fifth year is not covered by any of these merit-based scholarships. The price tag attached to attending TCNJ is a fair price for the type of school and prestige that it holds around the nation standing at around $30,000. Saint Joe’s, on the other hand, would charge around $70,000 dollars for that one extra year. Of course I could seek my academic counselor and teachers to ask for scholarship opportunities, but still that is an incredible amount of money. And with me leaning towards Saint Joe’s as my top choice, it will definitely be a number that looms over my head for the first four years of my college experience. For those first four years, I would be paying around $20,000 in order to attend either school.

I know I am not the only one terrified by the several zeros attached to that tuition price. I am thankful that my parents are helping me pay for my education (possibly in full). I have a supportive family that will allow me to attend any college that I wish to attend. Through high school, it was really my senior year that taught me that the college you attend does not matter in the long run. While Saint Joe’s is on the pricier side, they are known for offering more aid and merit money. I would like to consider myself a well achieving student who is involved in the East community and has been a part of Cum Laude for the past two years. I could’ve had my heart set on a top university. However, I decided to keep my options open and choose the smarter route financially. If you think about it, prospective college students and current college students are all working towards the same degree just with a different college name slapped on it. So my one piece of advice to those who are about to start the college application process: do not spend an insane amount of money on your undergraduate degree, especially if you decide to purse a graduate degree. You can find a great education at an in-state school like Rutgers, TCNJ or Montclair for half or even more than half of the price of an Ivy League or other prestigious college. I am beyond proud of those who have gotten into those schools and want to make it clear that I am not criticizing their choice at all. It is a commendable accomplishment, but I like to see college as an opportunity to further my education and in doing so pay the smallest amount of money I can.